AT&T Inc. Announces Pricing of Its Tender Offers

For more information, contact:

Name: Erin McGrath

AT&T Corporate and Financial Communications

Phone: (214)-862-0651

Email: EM3380@att.com

For Holders of Notes, contact:

Global Bondholder Services Corporation

Phone: (866) 470-3900 (toll free)

(212) 430-3774 (collect)

AT&T INC. ANNOUNCES PRICING OF ITS TENDER OFFERS

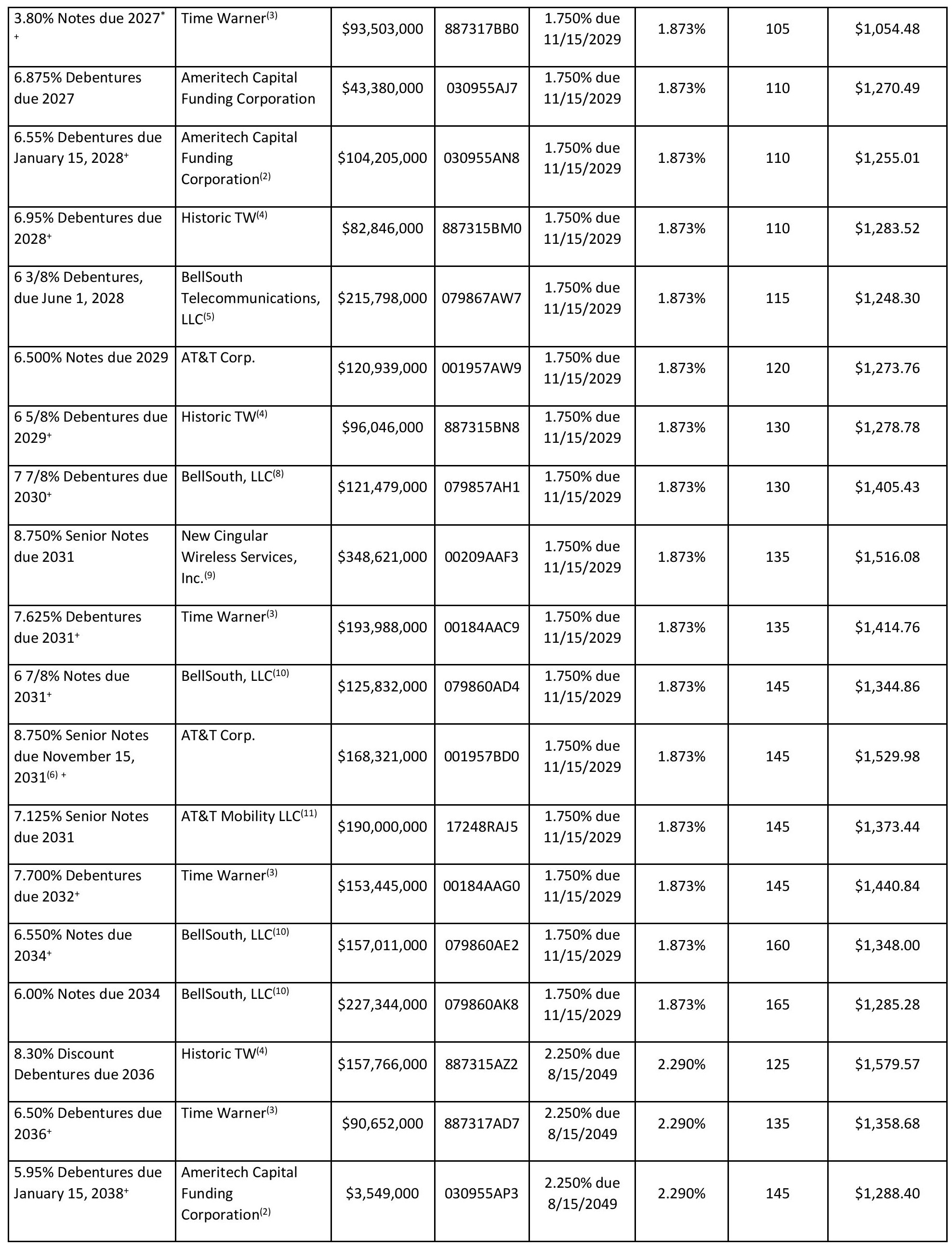

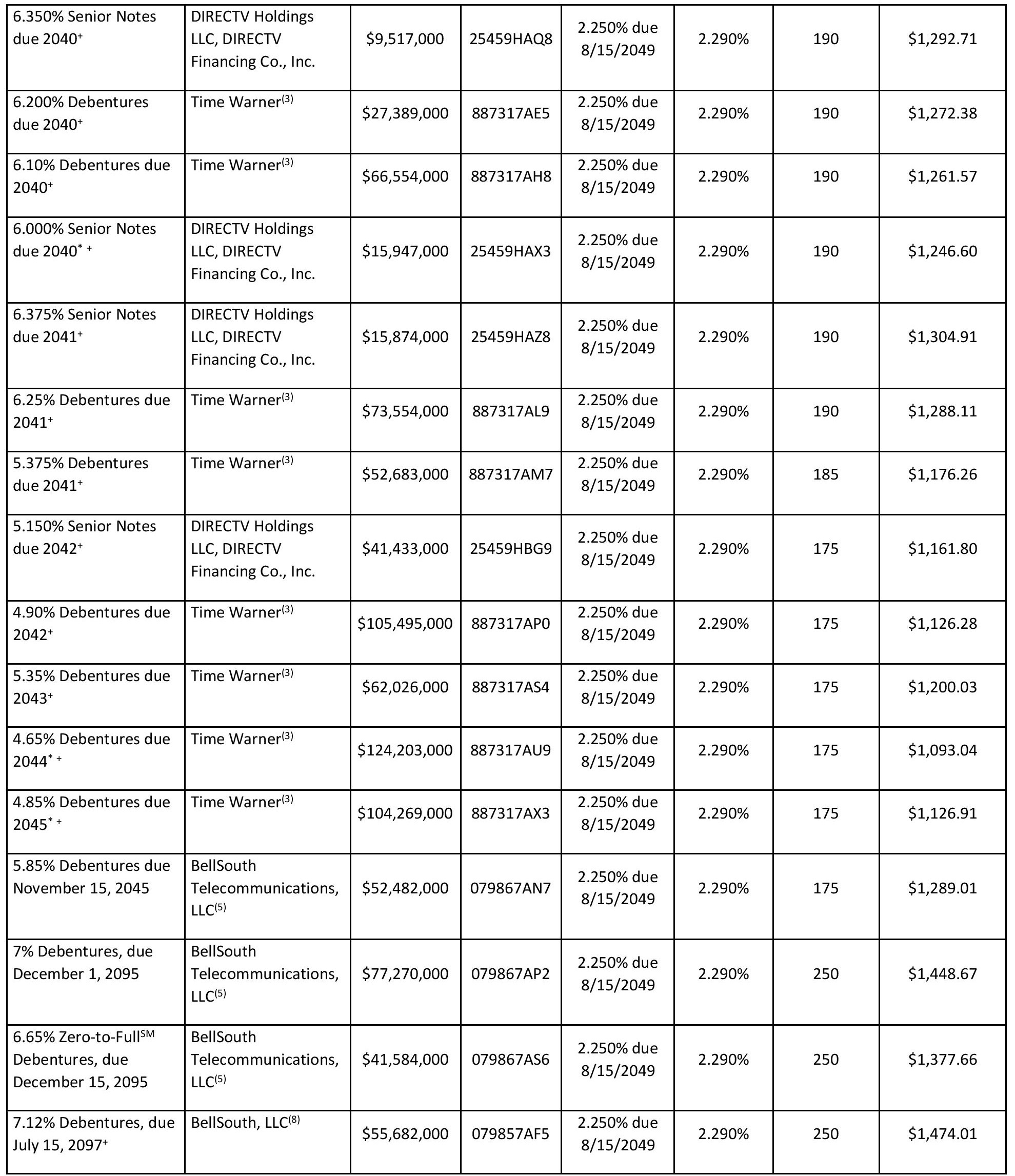

AT&T Inc. (NYSE: T) announced today the pricing of its fifty-three offers to purchase for cash any and all of the outstanding notes listed in the table below (collectively, the “Notes”). The offers were made on the terms and conditions set forth in the offer to purchase dated November 18, 2019 and the accompanying letter of transmittal.

The table below sets forth the Total Consideration for each series of the Notes as described in the offer to purchase. The reference yields are based on the bid-side price of the applicable reference U.S. treasury security as displayed on Bloomberg reference page PX1 at 11:00 a.m., New York City time, on December 16, 2019.

(1) Per $1,000 principal amount of Notes validly tendered, and not validly withdrawn, and accepted for purchase, at or prior to the Expiration Date; excludes the Accrued Coupon Payment (defined below).

(2) The 7.85% Debentures due January 15, 2022, the 7 1/8% Debentures due March 15, 2026, the 7.30% Debentures due August 15, 2026, the 6.55% Debentures due January 15, 2028 and the 5.95% Debentures due January 15, 2038 are unconditionally and irrevocably guaranteed by AT&T, with the full amount payable by specified subsidiaries so long as all of the outstanding shares of stock of the subsidiary are owned, directly or indirectly, by AT&T. In the event AT&T sells, transfers or otherwise disposes of any percentage of its stock ownership of a subsidiary and such subsidiary is no longer wholly-owned, then the guarantee will expire immediately and AT&T will be released immediately from any and all of its obligations. The subsidiaries named in this guarantee are Southwestern Bell Telephone Company, Pacific Bell Telephone Company, The Southern New England Telephone Company, Southern New England Telecommunications Corporation, Ameritech Capital Funding Corporation, The Ohio Bell Telephone Company, Wisconsin Bell, Inc., Michigan Bell Telephone Company, Indiana Bell Telephone Company Inc., and Illinois Bell Telephone Company.

Holders will also receive accrued and unpaid interest on the Notes accepted for purchase from the last interest payment date for such Notes to, but not including, the date AT&T makes payment for such Notes (the “Accrued Coupon Payment”), which is anticipated to be December 19, 2019.

The offers will expire at 11:59 p.m., New York City time, on December 16, 2019. The withdrawal deadline will occur at 11:59 p.m., New York City time, on December 16, 2019.

This press release is not an offer to sell or a solicitation of an offer to buy any of the securities described herein. The offers are being made solely by the offer to purchase and the related letter of transmittal and only to such persons and in such jurisdictions as is permitted under applicable law.

Neither the communication of this press release, the offer to purchase or any other offer materials relating to the offers is being made, and such documents and/or materials have not been approved by an authorized person for the purposes of section 21 of the UK Financial Services and Markets Act 2000 (the “FSMA”). Accordingly, this press release, the offer to purchase and such documents and/or materials are not being distributed to, and must not be passed on to persons in the United Kingdom other than (a) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (b) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order.

Deutsche Bank Securities Inc. and Goldman Sachs & Co. LLC are acting as the Joint-Lead Dealer Managers for the offers. For additional information regarding the terms of the offers, please contact Deutsche Bank Securities Inc. at (866) 627-0391 (toll free) or (212) 250-2955 (collect) or Goldman Sachs & Co. LLC at (800) 828-3182 (toll free) or (212) 902-6351 (collect). Global Bondholder Services Corporation will act as the tender agent and information agent for the offers. Questions or requests for assistance related to the offers or for additional copies of the offer to purchase or letter of transmittal may be directed to Global Bondholder Services Corporation at (866) 470-3900 (toll free) or (212) 430-3774 (collect). You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the offers. The offer to purchase and the letter of transmittal can be accessed at the following link: http://gbsc-usa.com/att.

###

CAUTIONARY LANGUAGE CONCERNING FORWARD-LOOKING STATEMENTS

Information set forth in this news release contains forward-looking statements that are subject to risks and uncertainties, and actual results may differ materially. A discussion of factors that may affect future results is contained in AT&T’s filings with the Securities and Exchange Commission and the Offer to Purchase related to the Tender Offers. AT&T disclaims any obligation to update or revise statements contained in this news release based on new information or otherwise.