AT&T Inc. Announces Final Results of Its Cash Offers

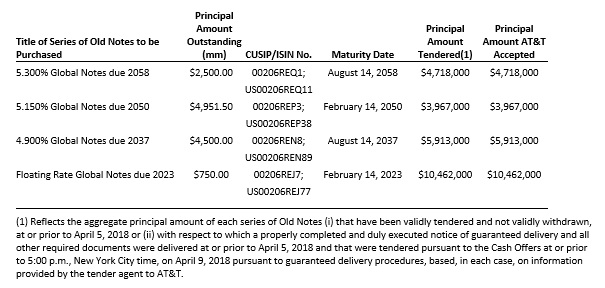

AT&T Inc. (NYSE: T) (“AT&T”) announced today the final results of its four separate offers to purchase for cash (the “Cash Offers”), any and all of the outstanding notes listed in the table below which have a special mandatory redemption provision (collectively, the “Old Notes”), on the terms and subject to the conditions set forth in the Offer to Purchase dated March 29, 2018 (the “Offer to Purchase” and, together with the accompanying notice of guaranteed delivery, the “Cash Offer Documents”).

The Cash Offers expired at 5:00 p.m., New York City time, on April 5, 2018. Based on the amount of Old Notes tendered in the Cash Offers and in accordance with the terms of the Cash Offers, AT&T accepted, on April 10, 2018, the Old Notes validly tendered and not validly withdrawn pursuant to the Cash Offers as set forth in the table below.

In connection with the settlement of the Cash Offers, AT&T paid aggregate total consideration of (i) $10,488,155.00 for the Floating Rate Global Notes due 2023, plus accrued and unpaid interest of $43,529.44; (ii) $5,927,782.50 for the 4.900% Global Notes due 2037, plus accrued and unpaid interest of $45,070.18; (iii) $3,976,917.50 for the 5.150% Global Notes due 2050, plus accrued and unpaid interest of $31,780.08 and (iv) $4,729,795.00 for the 5.300% Global Notes due 2058, plus accrued and unpaid interest of $38,897.26, in each case for the respective series of Old Notes validly tendered and accepted for purchase pursuant to the Cash Offers.

Interest ceased to accrue on April 10, 2018 for all Old Notes accepted, including those tendered through the guaranteed delivery procedures.

All holders of Old Notes were authorized to participate in the Cash Offers.

This press release is not an offer to sell or a solicitation of an offer to buy any of the securities described herein. The Cash Offers were made solely by the Cash Offer Documents and only to such persons and in such jurisdictions as is permitted under applicable law.

Credit Suisse Securities (USA) LLC, J.P. Morgan Securities LLC, Mizuho Securities USA LLC and Wells Fargo Securities, LLC acted as the Joint-Lead Dealer Managers for the Cash Offers. Global Bondholder Services Corporation acted as the tender agent and information agent for the Cash Offers. Questions related to the Cash Offers may be directed to Global Bondholder Services Corporation at (866) 470-3900 (toll free) or (212) 430-3774 (collect).

CAUTIONARY LANGUAGE CONCERNING FORWARD-LOOKING STATEMENTS

Information set forth in this news release contains forward-looking statements that are subject to risks and uncertainties, and actual results may differ materially. A discussion of factors that may affect future results is contained in AT&T’s filings with the Securities and Exchange Commission and the Offer to Purchase related to the Cash Offers. AT&T disclaims any obligation to update or revise statements contained in this news release based on new information or otherwise.