AT&T INC. ANNOUNCES EXPIRATION AND UPSIZING OF ITS TENDER OFFERS FOR 63 SERIES OF NOTES

DALLAS, May 23, 2022 — AT&T Inc. (NYSE: T) (“AT&T”) announced today the expiration of its offers to purchase for cash (i) 54 series of outstanding Notes listed in the table below under “Higher Coupon Offers” and (ii) 9 series of outstanding Notes listed in the table below under “Discount Offers” (collectively, the “Notes”) and that it has amended the Offers to Purchase (as defined below) by increasing the Maximum Purchase Consideration for the Higher Coupon Offers from $5.0 billion to $5.5 billion and for the Discount Offers from $3.0 billion to $3.2 billion. The Offers described herein were made on the terms and conditions set forth in the Offers to Purchase, dated May 16, 2022 (the “Offers to Purchase”), the Letter of Transmittal and the related Notices of Guaranteed Delivery (together with the Offers to Purchase and the Letter of Transmittal, the “Tender Offer Documents”). Capitalized terms used but not defined in this announcement have the meanings given to them in the Offers to Purchase.

The Offers to Purchase expired at 5:00 p.m., New York City time, on May 20, 2022 (the “Expiration Date”). The settlement date for the Offers will be May 26, 2022 (the “Settlement Date”).

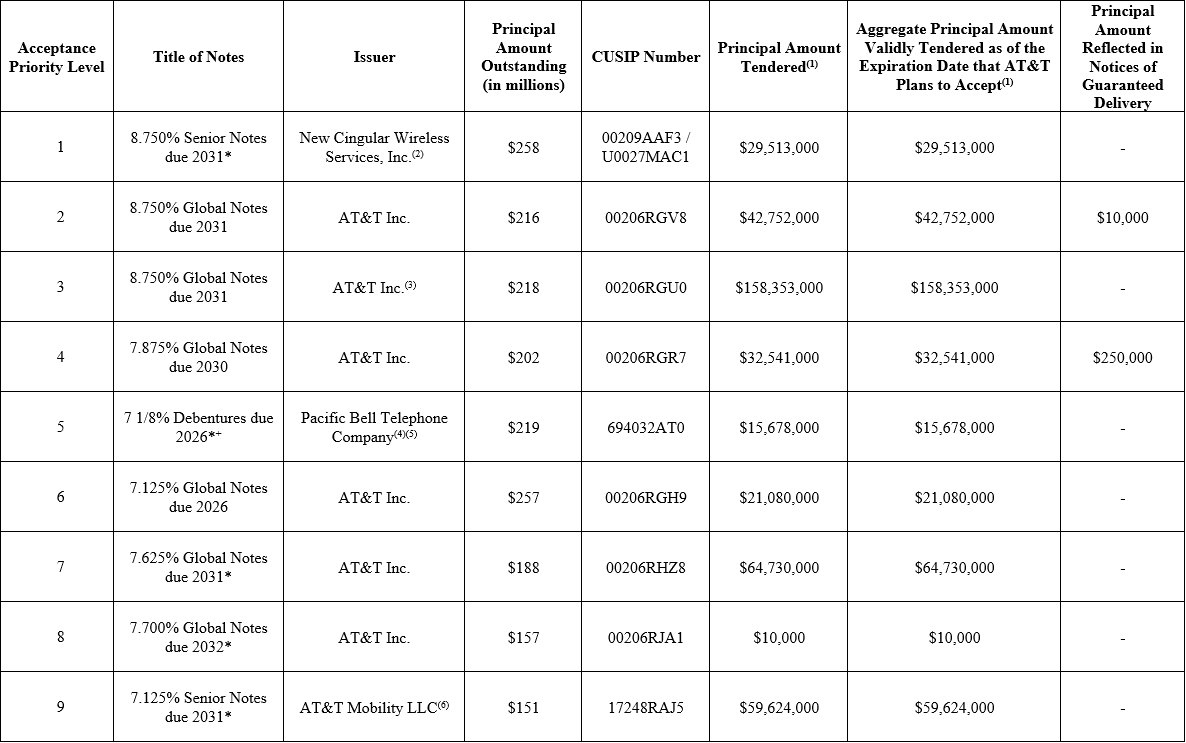

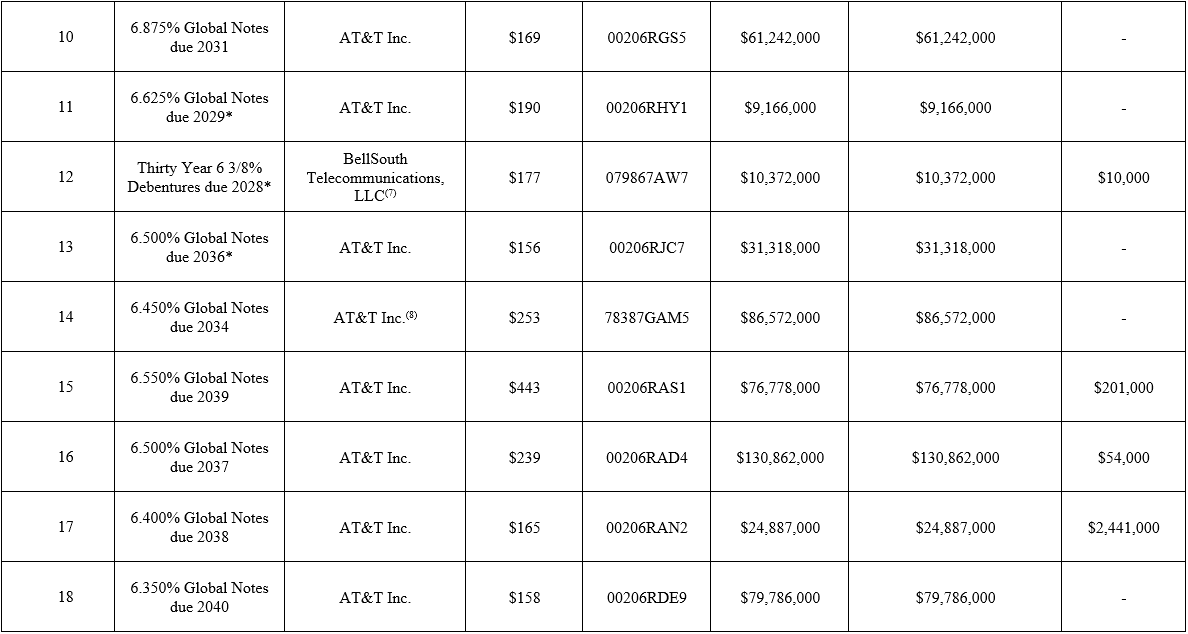

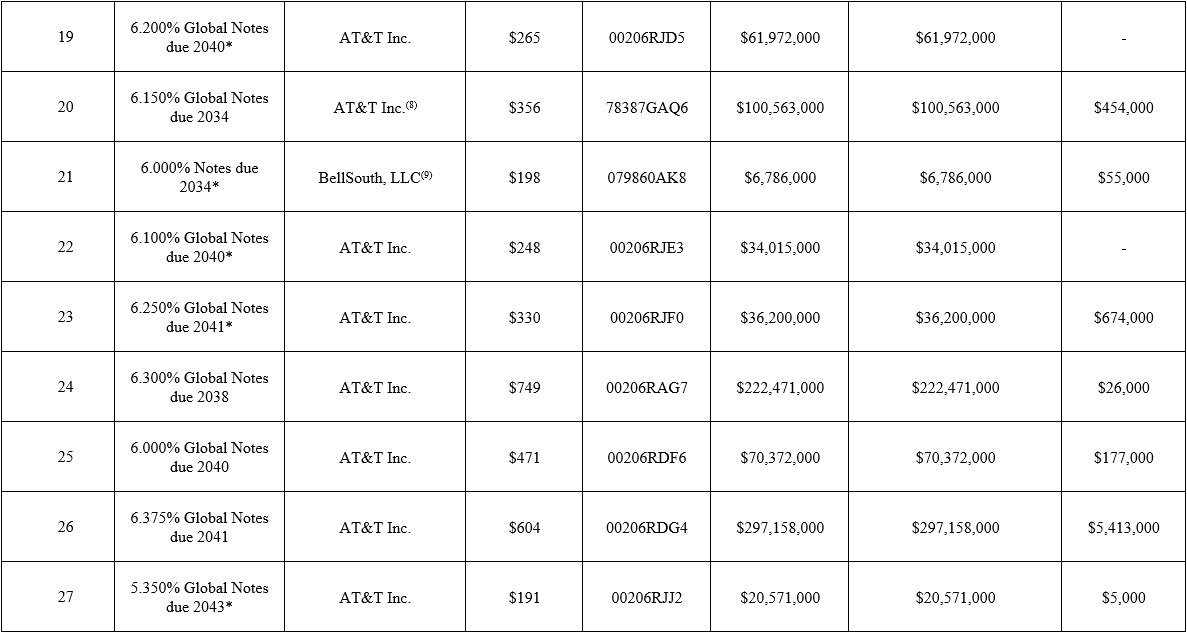

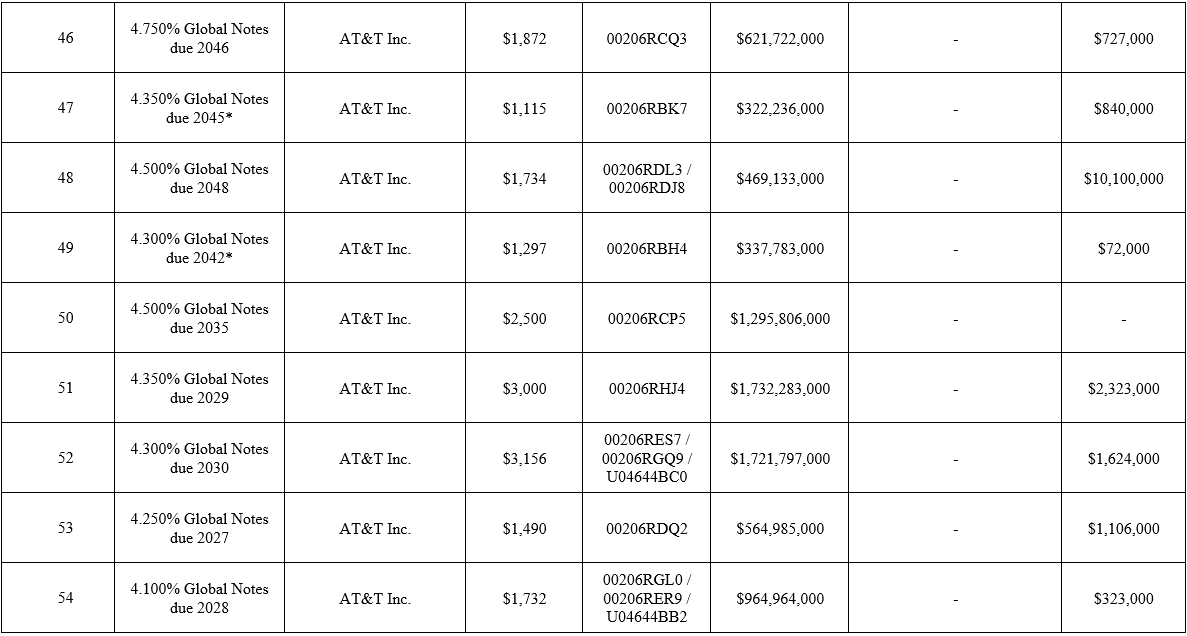

HIGHER COUPON OFFERS

According to information provided by Global Bondholder Services Corporation, $14,723,973,000 combined aggregate principal amount of the applicable Notes were validly tendered in connection with the Higher Coupon Offers prior to or at the Expiration Date and not validly withdrawn. In addition, $95,472,000 combined aggregate principal amount of the applicable Notes were tendered pursuant to the Guaranteed Delivery Procedures (as defined in the Higher Coupon Offer to Purchase) and remain subject to the Holders’ performance of the delivery requirements under such procedures. The table below provides certain information about the Higher Coupon Offers, including the aggregate principal amount of each series of Notes validly tendered and not validly withdrawn prior to the Expiration Date and the aggregate principal amount of Notes reflected in Notices of Guaranteed Delivery delivered at or prior to the Expiration Date.

Overall, AT&T plans to accept for purchase $4,788,384,000 combined aggregate principal amount of Notes under the Higher Coupon Offers (excluding Notes delivered pursuant to the Guaranteed Delivery Procedures). The Maximum Purchase Condition (after giving effect to the increase described above) has been satisfied with respect to the Higher Coupon Offers in respect of the series of Notes with Acceptance Priority Levels of 1-40. Accordingly, AT&T plans to accept for purchase all Notes of those series that have been validly tendered and not validly withdrawn at or prior to the Expiration Date. AT&T will not accept any Notes with Acceptance Priority Levels 41-54 (as indicated in the table below) and will promptly return all validly tendered Notes of such series to the respective tendering Holders.

For Holders who delivered a Notice of Guaranteed Delivery and all other required documentation at or prior to the Expiration Date, upon the terms and subject to the conditions set forth in the applicable Tender Offer Documents, the deadline to validly tender Notes using the Guaranteed Delivery Procedures will be 5:00 p.m. (New York City time) on May 24, 2022.

Upon the terms and subject to the conditions set forth in the applicable Tender Offer Documents, Holders whose Notes have been accepted for purchase in the Higher Coupon Offers will receive the applicable Total Consideration (the “Higher Coupon Total Consideration”) for each $1,000 principal amount of such Notes in cash on the Settlement Date. In addition to the Higher Coupon Total Consideration, Holders whose Notes are accepted for purchase will receive a cash payment equal to the Accrued Coupon Payment, representing accrued and unpaid interest on such Notes from and including the immediately preceding interest payment date for such Notes to, but excluding, the Settlement Date. Interest will cease to accrue on the Settlement Date for all Notes accepted in the Higher Coupon Offers, including those tendered through the Guaranteed Delivery Procedures.

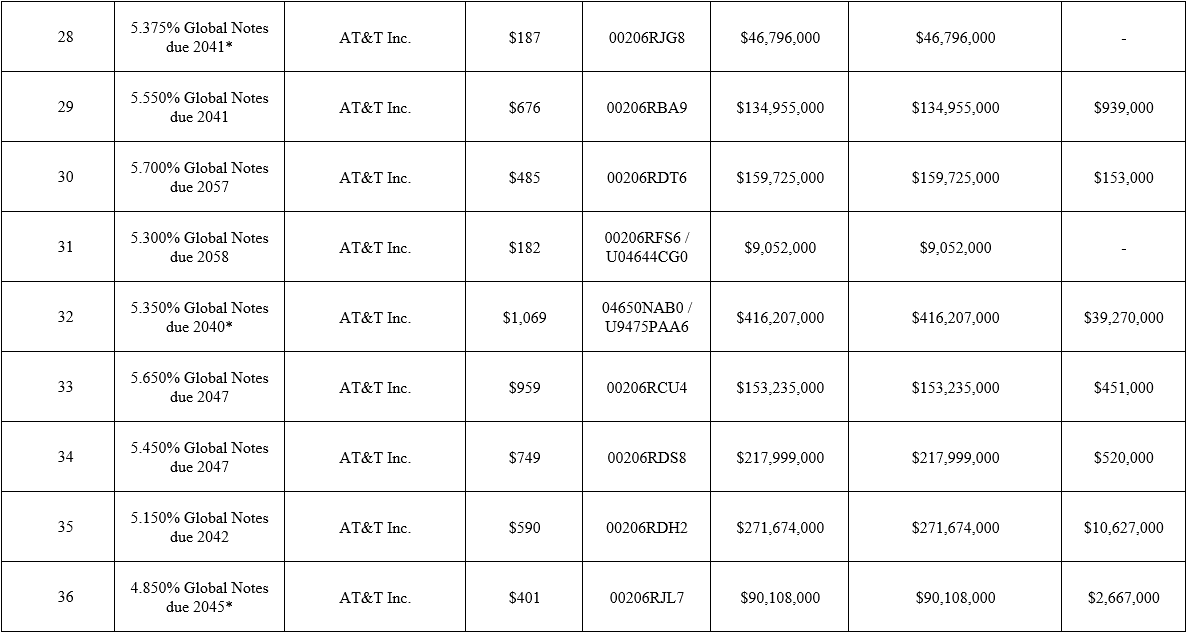

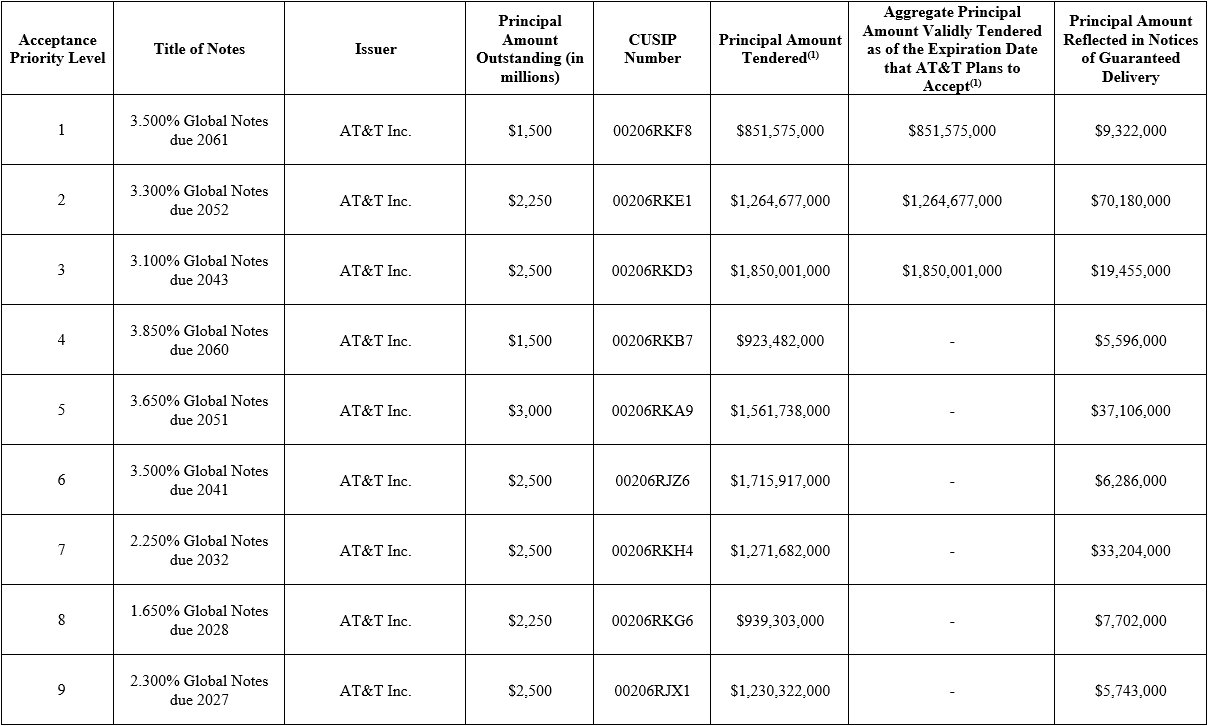

DISCOUNT OFFERS

According to information provided by Global Bondholder Services Corporation, $11,608,697,000 combined aggregate principal amount of the applicable Notes were validly tendered in connection with the Discount Offers prior to or at the Expiration Date and not validly withdrawn. In addition, $194,594,000 combined aggregate principal amount of the applicable Notes were tendered pursuant to the Guaranteed Delivery Procedures (as defined in the Discount Offer to Purchase) and remain subject to the Holders’ performance of the delivery requirements under such procedures. The table below provides certain information about the Discount Offers, including the aggregate principal amount of each series of Notes validly tendered and not validly withdrawn prior to the Expiration Date and the aggregate principal amount of Notes reflected in Notices of Guaranteed Delivery delivered at or prior to the Expiration Date.

Overall, AT&T plans to accept for purchase $3,966,253,000 combined aggregate principal amount of Notes under the Discount Offers (excluding Notes delivered pursuant to the Guaranteed Delivery Procedures). The Maximum Purchase Condition (after giving effect to the increase described above) has been satisfied with respect to the Discount Offers in respect of the series of Notes with Acceptance Priority Levels of 1-3. Accordingly, AT&T plans to accept for purchase all Notes of those series that have been validly tendered and not validly withdrawn at or prior to the Expiration Date. AT&T will not accept any Notes with Acceptance Priority Levels 4-9 (as indicated in the table below) and will promptly return all validly tendered Notes of such series to the respective tendering Holders.

For Holders who delivered a Notice of Guaranteed Delivery and all other required documentation at or prior to the Expiration Date, upon the terms and subject to the conditions set forth in the applicable Tender Offer Documents, the deadline to validly tender Notes using the Guaranteed Delivery Procedures will be 5:00 p.m. (New York City time) on May 24, 2022.

Upon the terms and subject to the conditions set forth in the applicable Tender Offer Documents, Holders whose Notes have been accepted for purchase in the Discount Offers will receive the applicable Total Consideration (the “Discount Offers Total Consideration”) for each $1,000 principal amount of such Notes in cash on the Settlement Date. In addition to the Discount Offers Total Consideration, Holders whose Notes are accepted for purchase will receive a cash payment equal to the Accrued Coupon Payment, representing accrued and unpaid interest on such Notes from and including the immediately preceding interest payment date for such Notes to, but excluding, the Settlement Date. Interest will cease to accrue on the Settlement Date for all Notes accepted in the Discount Offers, including those tendered through the Guaranteed Delivery Procedures.

Deutsche Bank Securities Inc., TD Securities, Goldman Sachs & Co. LLC and Citigroup are acting as the Joint-Lead Dealer Managers for the tender offers. For additional information regarding the terms of the offers, please contact Deutsche Bank Securities Inc. at (866) 627-0391 (toll free) or (212) 250-2955 (collect), TD Securities at (866) 627-0391 (toll free) or (212) 250-2955 (collect), Goldman Sachs & Co. LLC at (800) 828-3182 (toll free) or (212) 357-1452 (collect) or Citigroup at (800) 558-3745 (toll free) or (212) 723-6106 (collect). Global Bondholder Services Corporation is acting as the tender agent and information agent for the tender offers. Questions or requests for assistance related to the tender offers or for additional copies of the Offers to Purchase, the Letter of Transmittal or related Notices of Guaranteed Delivery may be directed to Global Bondholder Services Corporation at (855) 654-2014 (toll free) or (212) 430-3774 (collect). You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the tender offers. The Offers to Purchase, the Letter of Transmittal and the Notices of Guaranteed Delivery can be accessed at the following link: https://gbsc-usa.com/registration/att.

This press release is not an offer to sell or a solicitation of an offer to buy any of the securities described herein. The tender offers described herein were made solely by the applicable Offer to Purchase, the Letter of Transmittal and any related Notice of Guaranteed Delivery and only to such persons and in such jurisdictions as is permitted under applicable law.

Neither the communication of this press release, the applicable Offer to Purchase or any other offer materials relating to the tender offers is being made, and such documents and/or materials have not been approved by an authorized person for the purposes of section 21 of the UK Financial Services and Markets Act 2000 (the “FSMA”). Accordingly, this press release, the Offers to Purchase and such documents and/or materials are not being distributed to, and must not be passed on to persons in the United Kingdom other than (a) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (b) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (such persons together being “relevant persons”). This press release and the Offers to Purchase are only available to relevant persons and the transactions contemplated herein will be available only to, or engaged in only with relevant persons, and must not be relied or acted upon by persons other than relevant persons.