DALLAS, July 26, 2023 — AT&T Inc. (NYSE: T) delivered strong second-quarter results with profitable subscriber growth and year over year increases in Mobility service and broadband revenues.

Consistent strategy driving strong second-quarter results

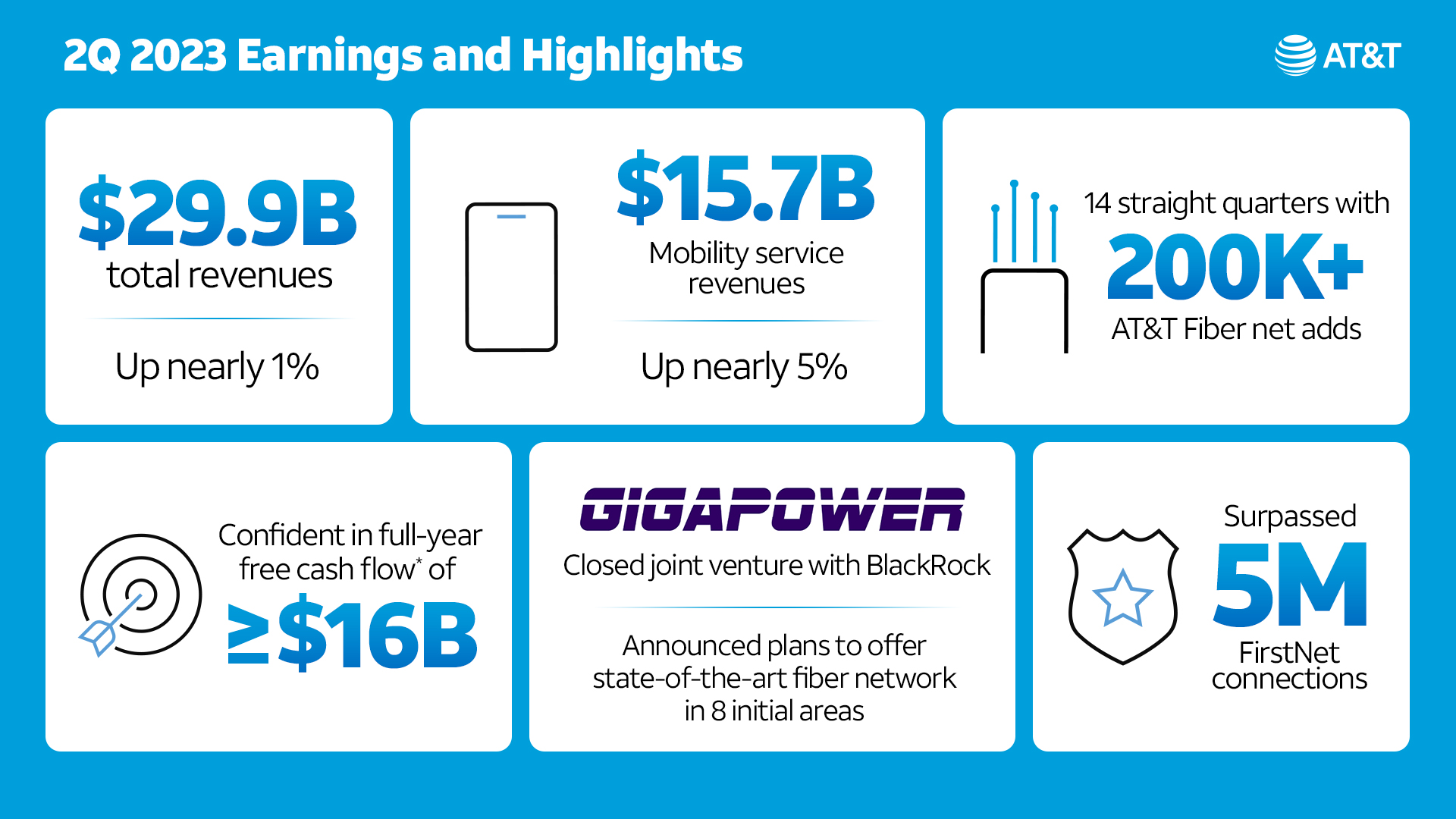

- Revenues of $29.9 billion, up 0.9% year over year

- Cash from operating activities of $9.9 billion, up 28.2% year over year and up $1.2 billion in first-half 2023 compared to first-half 2022

- Free cash flow* of $4.2 billion, up $1.0 billion in first-half 2023 compared to first-half 2022; confident in full-year free cash flow* of $16 billion or better

- Operating income of $6.4 billion, up 29.3% year over year

- On track for full-year Adjusted EBITDA* growth of more than 3%

“The direction we set three years ago is sound, and we’re on the right trajectory. Compared to last year, Mobility service and broadband revenues are up, Adjusted EBITDA is up, free cash flow is up, Mobility and Consumer Wireline margins are up and customer lifetime values are up,” said John Stankey, AT&T CEO. “We’re focused on growing the right way, adding profitable 5G and fiber customers. We are also committing to an incremental $2 billion-plus in cost savings beyond the $6 billion we have accomplished over this period, reflecting our continued march to operating the company in a more focused and streamlined fashion. Our results give us full confidence in delivering our full-year financial guidance.”

Establishing a foundation for durable, long-term growth

- Delivered 326,000 postpaid phone net adds with continued strong ARPU growth and historically low levels of churn

- Mobility service revenues up 4.9%; achieved company’s best-ever second-quarter Mobility operating income

- 251,000 AT&T Fiber net adds; 14 straight quarters with more than 200,000 net adds

- Consumer broadband revenues up 7.0%, driven by AT&T Fiber revenue growth of 28.0%

- Surpassed 5 million FirstNet® connections; FirstNet continues to be the leading choice for the first responder community

- Named #1 in wireless customer satisfaction by the American Customer Satisfaction Index

A leading investor in America’s broadband infrastructure

- Expanded most reliable 5G network1; mid-band 5G spectrum now covers more than 175 million people; remain on track to reach 200 million people with mid-band 5G by the end of the year

- Grew country’s largest consumer fiber network; ability to serve 20.2 million consumer and more than 3 million business customer locations with fiber; remain on track to pass 30 million-plus fiber locations by the end of 2025

- Closed joint venture with BlackRock to form Gigapower to provide a state-of-the-art fiber network to an initial 8 new areas

- Collaborated with AST SpaceMobile to achieve world-first direct voice call from space between unmodified everyday 4G LTE smartphones, connected via a low-earth orbit satellite; a key step in allowing us to provide even more expansive connectivity

Becoming more efficient and effective

- Achieved $6 billion-plus run-rate cost savings target six months ahead of schedule

- Increased target to $8 billion-plus run-rate cost savings with expectation of achieving incremental $2 billion-plus in run-rate cost savings over three years

- Accelerated cost-savings across the company with AI; collaborated with Microsoft to launch custom-built generative AI tool, Ask AT&T

Note: AT&T’s second-quarter earnings conference call will be webcast at 8:30 a.m. ET on Wednesday, July 26, 2023. The webcast and related materials, including financial highlights, will be available on AT&T’s Investor Relations website at https://investors.att.com.

Consolidated Financial Results

Revenues for the second quarter totaled $29.9 billion versus $29.6 billion in the year-ago quarter, up 0.9%. This increase primarily reflects higher Mobility, Mexico and Consumer Wireline revenues, partly offset by lower Business Wireline revenues.

Operating expenses were $23.5 billion versus $24.7 billion in the year-ago quarter reflecting prior year non-cash impairment charges of $0.6 billion and benefits of our continued transformation efforts, partially offset by inflationary cost increases. Operating expenses decreased primarily due to lower domestic wireless equipment and associated selling costs from lower sales volumes and lower personnel costs and higher returns on benefit-related assets. These decreases were partly offset by increased depreciation and higher amortization of deferred customer acquisition costs.

Operating income was $6.4 billion versus $5.0 billion in the year-ago quarter. When adjusting for certain items, adjusted operating income* was $6.4 billion versus $5.9 billion in the year-ago quarter.

Equity in net income of affiliates was $0.4 billion primarily from the DIRECTV investment. With an adjustment for our proportionate share of intangible amortization, adjusted equity in net income from the DIRECTV investment* was $0.7 billion.

Income from continuing operations was $4.8 billion, essentially stable with the year-ago quarter. Earnings per diluted common share from continuing operations2 was $0.61 versus $0.59 in the year-ago quarter. Adjusting for $0.02, which includes our proportionate share of intangible amortization from the DIRECTV equity method investment, net actuarial and settlement gains on benefit plans and other items, earnings per diluted common share from continuing operations* was $0.63 compared to $0.65 in the year-ago quarter.

Cash from operating activities from continuing operations was $9.9 billion, up $2.2 billion year over year, reflecting higher cash receipts from improved operations as well as timing of working capital, including higher receivable sales and lower device payments. Capital expenditures were $4.3 billion in the quarter versus $4.9 billion in the year-ago quarter. Capital investment*, which includes $1.6 billion of cash payments for vendor financing, totaled $5.9 billion.

Free cash flow* was $4.2 billion for the quarter. Total debt was $143.3 billion at the end of the quarter, and net debt* was $132.0 billion. The company expects to achieve a net debt-to-adjusted EBITDA* ratio in the 3.0x range by the end of this year and in the 2.5x range in the first half of 2025.

Communications Operational Highlights

Second-quarter revenues were $28.8 billion, up 0.5% year over year due to increases in Mobility and Consumer Wireline, which more than offset a decline in Business Wireline. Operating income was $7.2 billion, up 7.4% year over year, with operating income margin of 24.9%, compared to 23.3% in the year-ago quarter.

Mobility

- Revenues were up 2.0% year over year to $20.3 billion due to higher service revenues, partially offset by lower equipment revenues. Service revenues were $15.7 billion, up 4.9% year over year, primarily driven by subscriber and postpaid ARPU growth. Equipment revenues were $4.6 billion, down 7.2% year over year, driven by lower volumes.

- Operating expenses were $13.7 billion, down 1.3% year over year primarily due to lower equipment costs driven by lower device sales and lower content costs. These decreases were partly offset by increased amortization of deferred customer acquisition costs, higher network and customer support costs and higher depreciation expense.

- Operating income was $6.6 billion, up 9.3% year over year. Operating income margin was 32.6%, compared to 30.4% in the year-ago quarter.

- EBITDA* was $8.7 billion, up 8.3% year over year with EBITDA margin* of 43.0%, up from 40.5% in the year-ago quarter. This was the company’s best-ever second-quarter Mobility EBITDA*. EBITDA service margin* was 55.5%, up from 53.8% in the year-ago quarter.

- Total wireless net adds were 6.2 million, including:

- 464,000 postpaid net adds with:

- 326,000 postpaid phone net adds

- (70,000) postpaid tablet and other branded computing device net losses

- 208,000 other net adds

- 123,000 prepaid phone net adds

- Postpaid churn was 0.95% versus 0.93% in the year-ago quarter.

- Postpaid phone churn was 0.79% versus 0.75% in the year-ago quarter.

- Prepaid churn was 2.50%, with Cricket substantially lower, versus 2.59% in the year-ago quarter.

- Postpaid phone ARPU was $55.63, up 1.5% versus the year-ago quarter, due to prior-year pricing actions, higher international roaming and a mix shift to higher-priced unlimited plans.

- FirstNet connections reached more than 5.0 million across more than 26,000 agencies. FirstNet is the nationwide communications platform dedicated to public safety. The AT&T and FirstNet networks cover more than 99% of the U.S. population, and FirstNet covers more first responders than any other network in America.

Business Wireline

- Revenues were $5.3 billion, down 5.6% year over year due to lower demand for legacy voice and data services and product simplification, partly offset by growth in connectivity services.

- Operating expenses were $4.9 billion, down 4.3% year over year due to ongoing operational cost efficiencies, including lower personnel, lower wholesale network access costs, one-time cost benefits and lower marketing expenses.

- Operating income was $396 million, down 19.2%, with operating income margin of 7.5% compared to 8.8% in the year-ago quarter.

- EBITDA* was $1.7 billion, down 4.1% year over year with EBITDA margin* of 32.8%, compared to 32.2% in the year-ago quarter.

- AT&T Business serves the largest global companies, government agencies and small businesses. More than 750,000 U.S. business buildings are lit with fiber from AT&T, enabling high-speed fiber connections to more than 3 million U.S. business customer locations. Nationwide, more than 10 million business customer locations are on or within 1,000 feet of our fiber.3

Consumer Wireline

- Revenues were $3.3 billion, up 2.4% year over year due to gains in broadband more than offsetting declines in legacy voice and data and other services. Broadband revenues increased 7.0% due to fiber growth of 28.0%, partly offset by a 13.7% decline in non-fiber revenues.

- Operating expenses were $3.1 billion, up 1.8% year over year due to higher depreciation expense, higher network and maintenance costs and increased amortization of deferred customer acquisition costs, partly offset by lower customer support costs, including one-time cost benefits and lower content costs.

- Operating income was $168 million, up 15.9% year over year with operating income margin of 5.2%, compared to 4.6% in the year-ago quarter.

- EBITDA* was $1.0 billion, up 10.2% year over year with EBITDA margin* of 31.5%, up from 29.3% in the year-ago quarter.

- Total broadband net losses, excluding DSL, were 35,000, reflecting AT&T Fiber net adds of 251,000, more than offset by losses in non-fiber services. AT&T Fiber now has the ability to serve 20.2 million customer locations and offers symmetrical, multi-gig speeds across parts of its entire footprint of more than 100 metro areas.

Latin America – Mexico Operational Highlights

Revenues were $967 million, up 19.7% year over year due to growth in both service and equipment revenues. Service revenues were $635 million, up 18.9% year over year, driven by favorable foreign exchange, higher wholesale revenues and growth in subscribers. Equipment revenues were $332 million, up 21.2% year over year due to favorable foreign exchange and higher sales.

Operating loss was ($39) million compared to ($82) million in the year-ago quarter. EBITDA* was $146 million compared to $87 million in the year-ago quarter.

Total wireless net adds were 76,000, including 50,000 prepaid net adds, 56,000 postpaid net adds and 30,000 reseller net losses.

Read more Investor Relations news