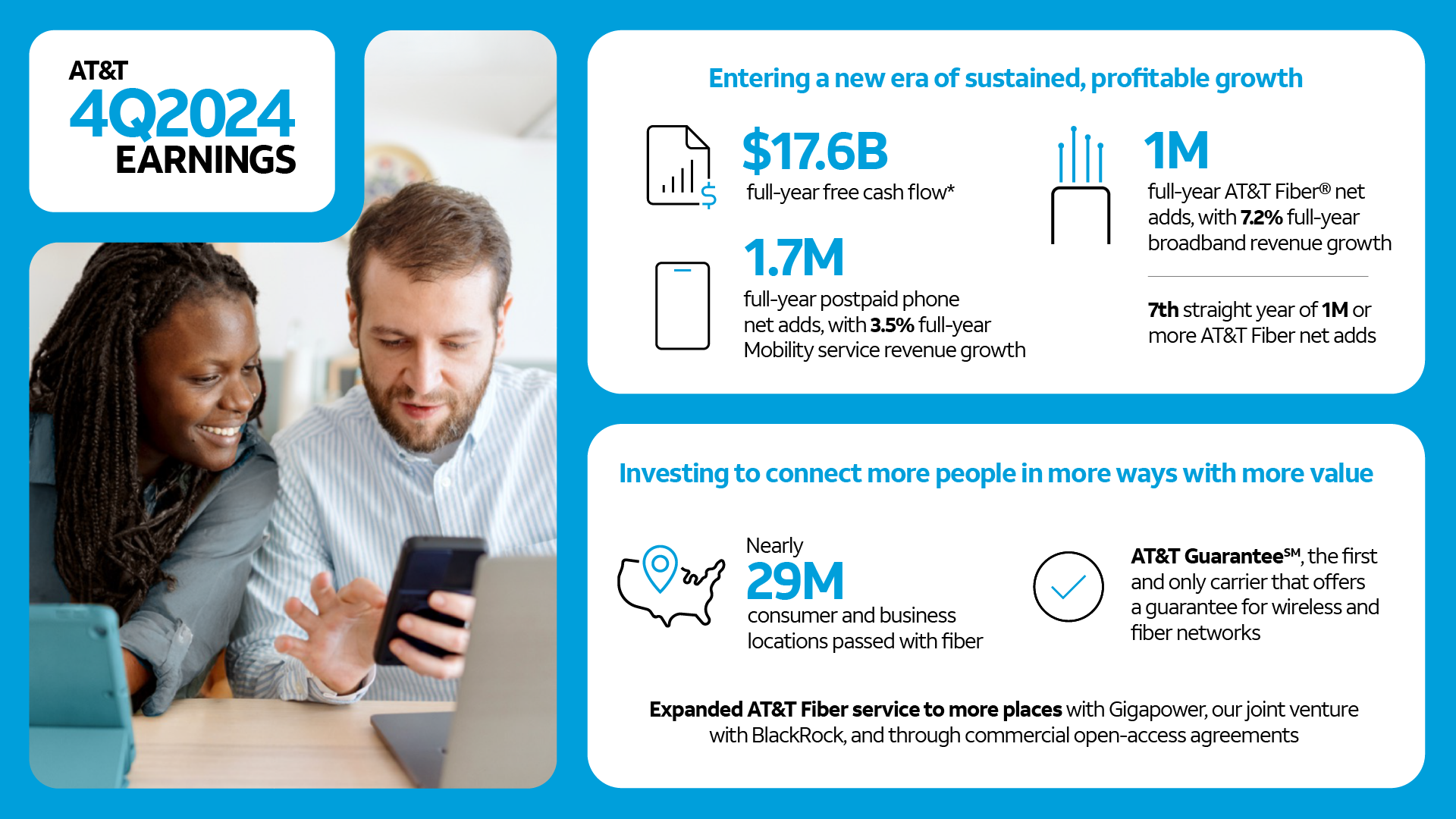

DALLAS, January 27, 2025 — AT&T Inc. (NYSE: T) reported strong fourth-quarter and full-year results that showcased solid momentum in gaining and retaining profitable 5G and fiber subscribers. The Company met all 2024 consolidated financial guidance and reiterates all financial and operational guidance for 2025 and beyond that was shared at its recent Analyst & Investor Day.

“The strong results this quarter are the result of a four-plus-year period of hard work and consistent execution by our teams, which has positioned us well for a new era of growth,” said John Stankey, AT&T CEO. “We ended 2024 with strong momentum. Customers and shareholders can look forward to receiving even more value in 2025 as we expand the country's largest fiber network, modernize our wireless network, grow our business and begin share repurchases in the second half of the year.”

Fourth-Quarter Consolidated Results

- Revenues of $32.3 billion

- Diluted EPS of $0.56; adjusted EPS* of $0.54

- Operating income of $5.3 billion; adjusted operating income* of $5.4 billion

- Net income of $4.4 billion; adjusted EBITDA* of $10.8 billion

- Cash from operating activities of $11.9 billion, up $0.5 billion year over year

- Capital expenditures of $6.8 billion; capital investment* of $7.1 billion

- Free cash flow* of $4.8 billion, down $1.5 billion year over year as the Company continued to drive a more ratable quarterly free cash flow cadence

Fourth-Quarter Highlights

- 482,000 postpaid phone net adds with an expected industry-leading postpaid phone churn of 0.85%

- Mobility service revenues of $16.6 billion, up 3.3% year over year

- 307,000 AT&T Fiber net adds; 200,000, or more, net adds for 20 consecutive quarters

- Consumer broadband revenues of $2.9 billion, up 7.8% year over year

Full-Year Consolidated Results

- Revenues of $122.3 billion

- Diluted EPS of $1.49; adjusted EPS* of $2.26

- Operating income of $19.0 billion; adjusted operating income* of $24.2 billion

- Net income of $12.3 billion; adjusted EBITDA* of $44.8 billion

- Cash from operating activities of $38.8 billion, up $0.5 billion year over year

- Capital expenditures of $20.3 billion; capital investment* of $22.1 billion

- Free cash flow* of $17.6 billion, up $0.9 billion year over year

Full-Year Highlights

- 1.7 million postpaid phone net adds with an expected industry-leading postpaid phone churn of 0.76%

- Mobility service revenues of $65.4 billion, up 3.5% year over year

- 1.0 million AT&T Fiber net adds; 1 million, or more, net adds for seven consecutive years

- Consumer broadband revenues of $11.2 billion, up 7.2% year over year

- 28.9 million consumer and business locations passed with fiber

2025 Outlook

For the full year, AT&T expects:

- Consolidated service revenue growth in the low-single-digit range.

- Mobility service revenue growth in the higher end of the 2% to 3% range.

- Consumer fiber broadband revenue growth in the mid-teens.

- Adjusted EBITDA* growth of 3% or better.

- Mobility EBITDA* growth in the higher end of the 3% to 4% range.

- Business Wireline EBITDA* to decline in the mid-teens range.

- Consumer Wireline EBITDA* growth in the high-single to low-double-digit range.

- Capital investment* in the $22 billion range.

- Free cash flow*, excluding DIRECTV, of $16 billion+.

- Adjusted EPS*, excluding DIRECTV, of $1.97 to $2.07.

The Company also expects to achieve net-debt-to-adjusted EBITDA* in the 2.5x range in the first half of 2025. Additionally, the Company continues to expect the sale of its entire 70% stake in DIRECTV to TPG to close in mid-2025.

Note: AT&T’s fourth-quarter earnings conference call will be webcast at 8:30 a.m. ET on Monday, January 27, 2025. The webcast and related materials, including financial highlights, will be available at https://investors.att.com/.

4Q24 Earnings & Highlights

Consolidated Financial Results

- Revenues for the fourth quarter totaled $32.3 billion versus $32.0 billion in the year-ago quarter, up 0.9%. This was due to higher Mobility service and equipment revenues and Consumer Wireline revenues, partially offset by declines in Business Wireline and Mexico.

- Operating expenses were $27.0 billion versus $26.8 billion in the year-ago quarter. Operating expenses increased primarily due to higher depreciation from accelerated depreciation on wireless network equipment associated with our Open RAN network modernization efforts, as well as our continued fiber investment and network upgrades. Additionally, equipment costs increased year over year in line with higher Mobility equipment revenues and these increases were partially offset by a prior-year charge, that did not recur, for the abandonment of non-deployed wireless equipment in connection with our network modernization efforts, and benefits from continued transformation.

- Operating income was $5.3 billion, consistent with the year-ago quarter. When adjusting for certain items, adjusted operating income* was $5.4 billion versus $5.8 billion in the year-ago quarter.

- Equity in net income of affiliates was $1.1 billion, primarily from the DIRECTV investment, versus $0.3 billion in the year-ago quarter, reflecting cash distributions received by AT&T in excess of AT&T's share of DIRECTV's earnings.

- Net income was $4.4 billion versus $2.6 billion in the year-ago quarter.

- Net income (loss) attributable to common stock was $4.0 billion versus $2.1 billion in the year-ago quarter. Earnings per diluted common share was $0.56 versus $0.30 in the year-ago quarter. Adjusting for ($0.02) which includes a benefit from tax items offset by an actuarial loss on benefit plans and other items, adjusted earnings per diluted common share* was $0.54, consistent with the year-ago quarter.

- Adjusted EBITDA* was $10.8 billion versus $10.6 billion in the year-ago quarter.

- Cash from operating activities was $11.9 billion, up $0.5 billion year over year, reflecting higher cash distributions from DIRECTV classified as operating, working capital timing, including lower device payments, and operational improvements, partially offset by higher cash tax payments.

- Capital expenditures were $6.8 billion versus $4.6 billion in the year-ago quarter. Capital investment* totaled $7.1 billion versus $5.6 billion in the year-ago quarter. Cash payments for vendor financing totaled $0.2 billion versus $1.0 billion in the year-ago quarter.

- Free cash flow* was $4.8 billion versus $6.4 billion in the year-ago quarter as the Company continued to drive a more ratable quarterly free cash flow cadence.

Full-Year Financial Results

- Revenues for the full year totaled $122.3 billion versus $122.4 billion in 2023, down 0.1%, primarily driven by lower revenues from Business Wireline service revenue and Mobility equipment revenue, offset by higher Mobility service and Consumer Wireline, and Mexico revenues.

- Operating expenses for the full year were $103.3 billion versus $99.0 billion in 2023, primarily due to a $4.4 billion non-cash goodwill impairment in the third quarter. Additionally, the annual increase was driven by our Open RAN network modernization efforts, including accelerated depreciation on wireless network equipment and restructuring costs, and higher depreciation from continued fiber investment and network upgrades, partially offset by lower Mobility equipment costs from lower sales volumes and benefits from continued transformation efforts, including lower personnel.

- Operating income for the full year was $19.0 billion versus $23.5 billion in 2023. When adjusting for certain items, adjusted operating income* was $24.2 billion versus $24.7 billion a year ago.

- Equity in net income of affiliates for the full year was $2.0 billion, primarily from the DIRECTV investment. With adjustment for our proportionate share of intangible amortization, adjusted equity in net income from the DIRECTV investment* for full-year 2024 was $2.8 billion.

- Net income for the full year was $12.3 billion versus $15.6 billion a year ago.

- Net income attributable to common stock for the full year was $10.7 billion versus $14.2 billion a year ago. Earnings per diluted common share was $1.49 versus $1.97 for full-year 2023. With adjustments for both years, adjusted earnings per diluted common share* was $2.26 compared to $2.41 for full-year 2023.

- Adjusted earnings per diluted common share, excluding DIRECTV*, was $1.95 for full-year 2024.

- Adjusted EBITDA* for the full year was $44.8 billion versus $43.4 billion a year ago.

- Cash from operating activities for the full year was $38.8 billion, up $0.5 billion from a year ago, reflecting working capital timing and operational improvements, partially offset by higher cash tax payments.

- Capital expenditures were $20.3 billion for the full year versus $17.9 billion a year ago. Capital investment* totaled $22.1 billion for the full year versus $23.6 billion a year ago. Cash payments for vendor financing totaled $1.8 billion versus $5.7 billion a year ago.

- Free cash flow* was $17.6 billion for the full year compared to $16.8 billion a year ago.

- Free cash flow, excluding DIRECTV*, was $15.3 billion for full-year 2024.

- Total debt was $123.5 billion at the end of the fourth-quarter 2024, and net debt* was $120.1 billion.

Segment and Business Unit Results

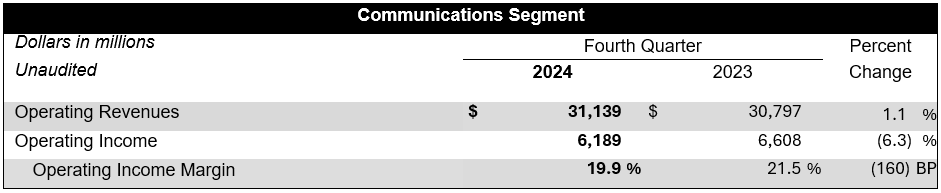

Communications segment revenues were $31.1 billion, up 1.1% year over year, with operating income down 6.3% year over year.

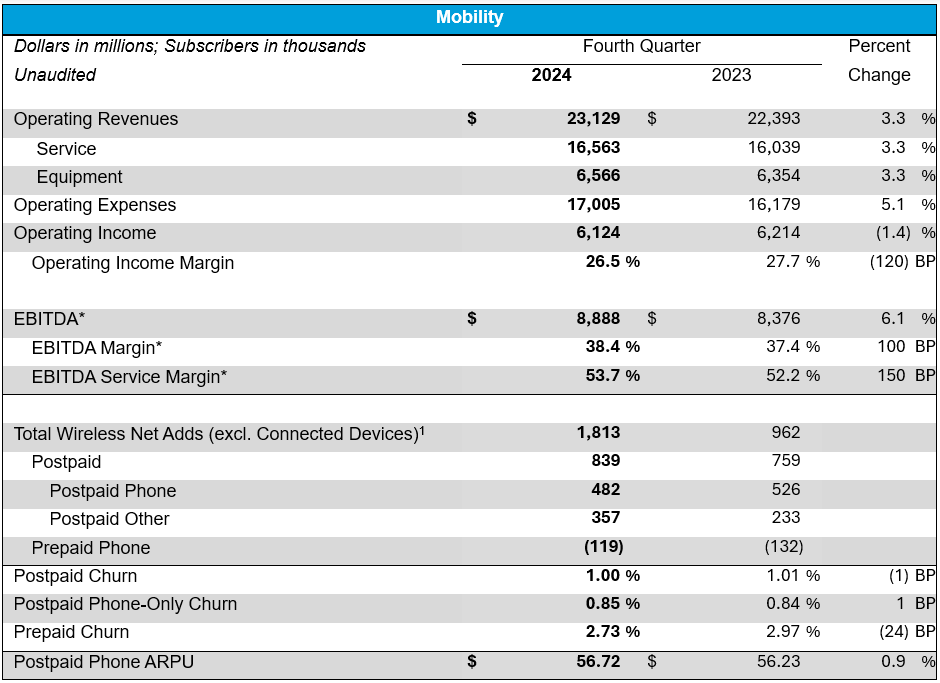

Mobility service revenue grew 3.3% year over year driving EBITDA service margin* expansion of 150 basis points. Postpaid phone net adds were 482,000 with postpaid phone churn of 0.85%, up 1 basis point year over year.

Mobility revenues were up 3.3% year over year driven by service revenue growth of 3.3% from subscriber gains and postpaid phone average revenue per subscriber (ARPU) growth, and equipment revenue growth of 3.3% from higher volumes of non-phone sales and higher priced phone sales. Operating expenses were up 5.1% year over year due to higher depreciation expense from Open RAN deployment and continued network transformation, higher equipment expenses resulting from higher sales and higher network costs, including storm impacts. Operating income was $6.1 billion, down 1.4% year over year. EBITDA* was $8.9 billion, up $512 million year over year, driven by service revenue growth. This was the Company’s highest-ever fourth-quarter Mobility EBITDA*.

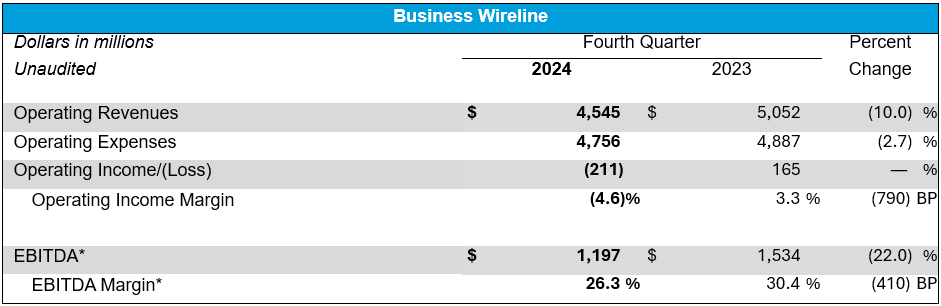

Business Wireline revenues and profitability declined year over year driven by continued secular pressures on legacy voice and data services that were partially offset by growth in fiber and other advanced connectivity services.

Business Wireline revenues were down 10.0% year over year, primarily due to lower demand for legacy voice and data services as well as product simplification, partially offset by growth in connectivity services. Revenue declines were also impacted by the absence of revenues from our cybersecurity business that was contributed to LevelBlue during the second quarter of 2024. Operating expenses were down 2.7% year over year due to lower personnel and customer support expenses, as well as the contribution of our cybersecurity business. Operating income was $(211) million versus $165 million in the prior-year quarter, and EBITDA* was $1.2 billion, down $337 million year over year.

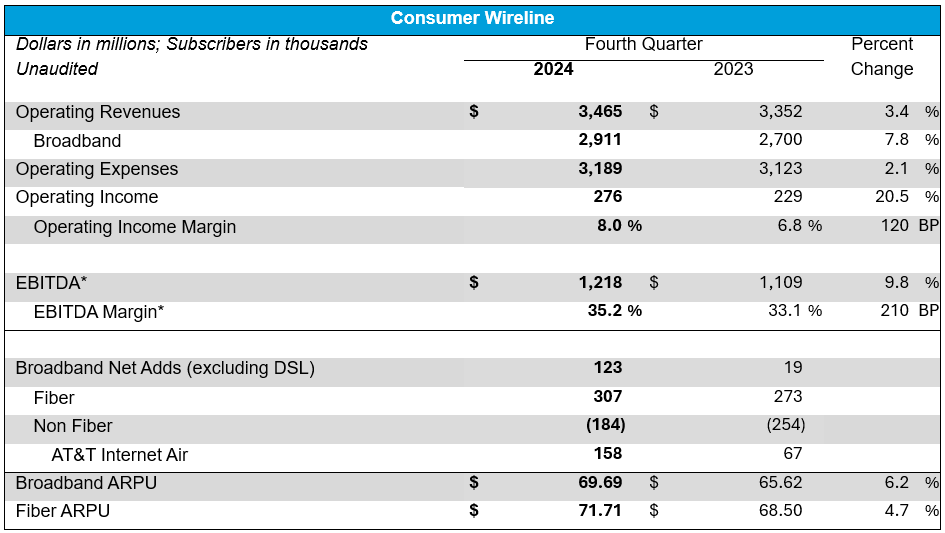

Consumer Wireline achieved strong broadband revenue growth with improving EBITDA margin*. Consumer Wireline also delivered positive broadband net adds for the sixth consecutive quarter, driven by 307,000 AT&T Fiber net adds and 158,000 AT&T Internet Air net adds.

Consumer Wireline revenues were up 3.4% year over year driven by growth in broadband revenues attributable to fiber revenues, which grew 17.8%, partially offset by declines in legacy voice and data services and other services. Operating expenses were up 2.1% year over year, primarily due to higher depreciation expense driven by fiber investment and higher network costs, including storm impacts, partially offset by savings from cost initiatives and lower marketing costs. Operating income was $276 million versus $229 million in the prior-year quarter, and EBITDA* was $1.2 billion, up $109 million year over year.

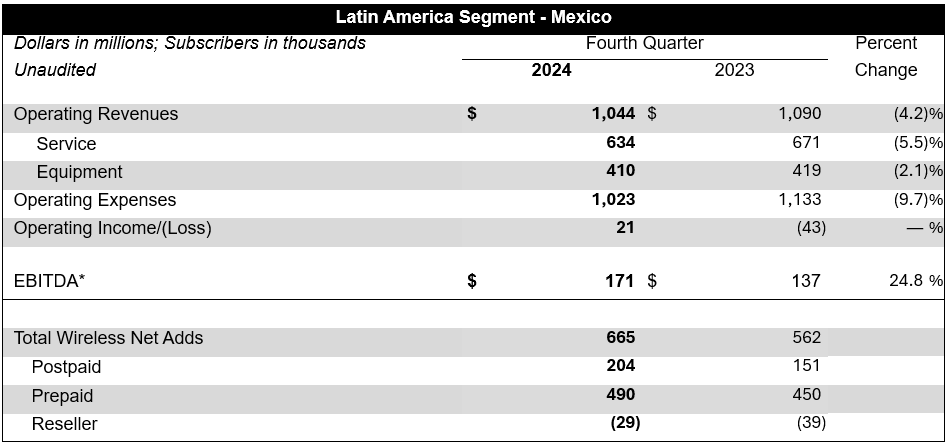

Latin America segment revenues were down 4.2% year over year, primarily due to unfavorable impacts of foreign exchange rates, offset by higher equipment sales and subscriber growth. Operating expenses were down 9.7% due to favorable impacts of foreign exchange rates, partially offset by higher equipment and selling costs attributable to subscriber growth. Operating income was $21 million compared to $(43) million in the year-ago quarter. EBITDA* was $171 million, up $34 million year over year.

Read more Investor Relations news