DALLAS, October 19, 2023 — AT&T Inc. (NYSE: T) again delivered strong results in the third quarter with solid 5G and fiber subscriber growth. The company also posted healthy year over year increases in Mobility service and broadband revenues, driving higher profitability.

Strong third-quarter results build on momentum

- Revenues of $30.4 billion, up 1% year over year

- Cash from operating activities of $10.3 billion, up $0.2 billion or 2.4% year over year; year-to-date, cash from operating activities is up $1.5 billion versus the same period a year ago.

- Free cash flow* of $5.2 billion, up $1.3 billion year over year; year-to-date, free cash flow is up $2.4 billion versus the same period a year ago.

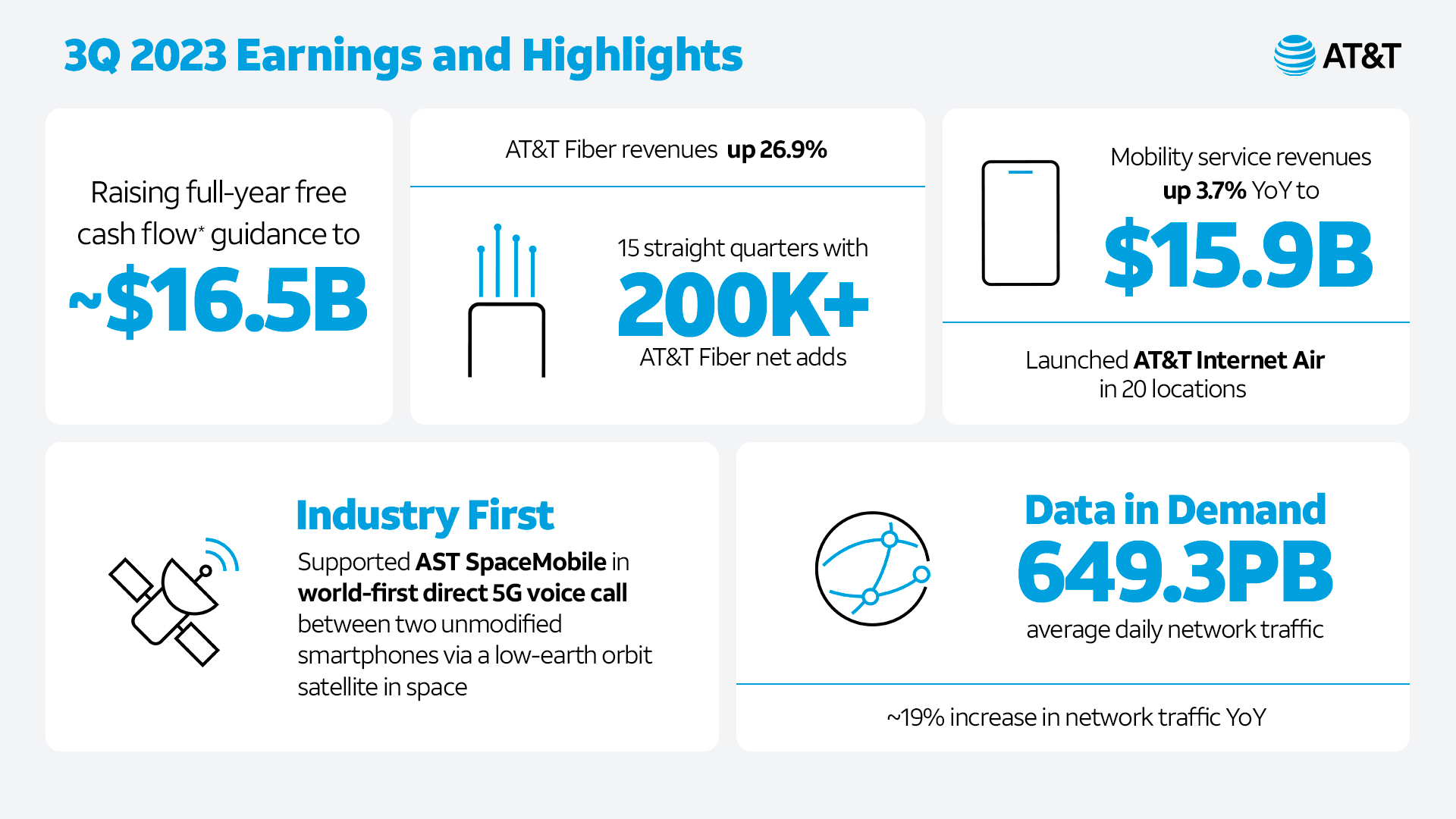

- The company now expects full-year free cash flow* of about $16.5 billion, versus prior guidance of $16 billion or better.

- Operating income of $5.8 billion, with adjusted operating income* of $6.5 billion

“Our investments in best-in-class 5G and fiber connectivity are fueling our growth engine. We’re gaining profitable customer relationships and becoming more efficient. This is powering our strong business performance and gives us the confidence to raise our full-year free cash flow guidance,” said John Stankey, AT&T CEO. “We are pleased that customers are choosing AT&T and staying with us over the long run as we connect and simplify their digital world.”

Sustainable strategy creates foundation for durable, long-term growth

- Delivered 468,000 postpaid phone net adds with continued strong ARPU growth and historically low levels of churn

- Mobility service revenues up 3.7%; achieved company’s best-ever Mobility operating income

- 296,000 AT&T Fiber net adds

- Consumer broadband revenues up 9.8%, driven by AT&T Fiber revenue growth of 26.9%

- Surpassed 8 million AT&T Fiber subscribers; doubled customer base in less than 4 years

- Launched AT&T Internet Air fixed wireless residential service; expect to be in 30+ locations by the end of the year

A leading investor in America’s broadband infrastructure

- Continued to enhance the largest wireless network in North America1 and expand the most reliable 5G network1 as we scale our 5G standalone; mid-band 5G spectrum now covers more than 190 million people, on track to reach 200 million people or more with mid-band 5G by year-end

- Grew the nation’s largest consumer fiber network, which is now capable of serving 20.7 million consumers and about 3.3 million business customer locations; on track to pass 30 million+ fiber locations by the end of 2025

- Supported AST SpaceMobile in world’s-first direct 5G voice call between two unmodified smartphones via a low-earth orbit satellite in space

Becoming more efficient and effective through innovation

- Strong early progress on achieving an incremental $2 billion+ run-rate cost savings target within the next three years

Note: AT&T’s third-quarter earnings conference call will be webcast at 8:30 a.m. ET on Thursday, October 19, 2023. The webcast and related materials, including financial highlights, will be available on AT&T’s Investor Relations website at https://investors.att.com.

Consolidated Financial Results

Revenues for the third quarter totaled $30.4 billion versus $30.0 billion in the year-ago quarter, up 1.0%. This increase primarily reflects higher Mobility, Mexico and Consumer Wireline revenues, partly offset by lower Business Wireline revenues. Revenue increases also reflect favorable impacts of foreign exchange rates in Mexico.

Operating expenses were $24.6 billion versus $24.0 billion in the year-ago quarter, reflecting higher severance and restructuring charges and continued inflationary cost increases in the third quarter of 2023, partially offset by continued transformation efforts. Operating expense increases also reflect increased depreciation expense, higher network costs, unfavorable impact of foreign exchange rates, and increased amortization of deferred customer acquisition costs. These increases were partially offset by lower Mobility equipment and associated selling costs from lower wireless sales volumes, and lower personnel costs.

Operating income was $5.8 billion versus $6.0 billion in the year-ago quarter. When adjusting for certain items, adjusted operating income* was $6.5 billion versus $6.2 billion in the year-ago quarter.

The company now expects full-year Adjusted EBITDA* growth of better than 4%, versus prior guidance of 3%+.

Equity in net income of affiliates was $0.4 billion, primarily from the DIRECTV investment. With an adjustment for our proportionate share of intangible amortization, adjusted equity in net income from the DIRECTV investment* was $0.7 billion.

Income from continuing operations was $3.8 billion, versus $6.3 billion in the year-ago quarter. Earnings per diluted common share from continuing operations2 was $0.48 versus $0.79 in the year-ago quarter. Adjusting for $0.16, which includes severance and restructuring charges, an impairment of an equity investment in a Latin America satellite business, our proportionate share of intangible amortization from the DIRECTV equity method investment and an actuarial gain on benefit plans and other items, earnings per diluted common share from continuing operations* was $0.64 compared to $0.68 in the year-ago quarter.

Cash from operating activities from continuing operations was $10.3 billion, up $0.2 billion year over year, reflecting operational growth and timing of working capital, including lower device payments partially offset by a lower net impact from receivable sales. Capital expenditures were $4.6 billion in the quarter versus $5.9 billion in the year-ago quarter. Capital investment*, which includes $1.0 billion of cash payments for vendor financing, totaled $5.6 billion.

Free cash flow* was $5.2 billion for the quarter. Total debt was $138.0 billion at the end of the quarter, and net debt* was $128.7 billion. The company expects to achieve net debt-to-adjusted EBITDA* in the 2.5x range in the first half of 2025.

Communications Operational Highlights

Third-quarter revenues were $29.2 billion, up 0.4% year over year due to increases in Mobility and Consumer Wireline, which more than offset a decline in Business Wireline. Operating income was $7.3 billion, up 4.1% year over year, with operating income margin of 24.9%, compared to 24.0% in the year-ago quarter.

Mobility

- Revenues were up 2.0% year over year to $20.7 billion due to higher service revenues. Service revenues were $15.9 billion, up 3.7% year over year, primarily driven by subscriber and postpaid phone ARPU growth. Equipment revenues were $4.8 billion, down 3.2% year over year due to lower device volumes.

- Operating expenses were $13.9 billion, down 0.9% year over year, primarily due to lower equipment costs and associated selling expenses driven by lower device sales, partly offset by higher network and customer support costs, increased amortization of deferred customer acquisition costs and higher depreciation expense.

- Operating income was $6.8 billion, up 8.6% year over year. Operating income margin was 32.7%, compared to 30.7% in the year-ago quarter.

- EBITDA* was $8.9 billion, up 7.6% year over year with EBITDA margin* of 43.0%, up from 40.8% in the year-ago quarter. This was the company’s best-ever quarterly Mobility EBITDA*. EBITDA service margin* was 55.9%, up from 53.9% in the year-ago quarter.

- Total wireless net adds were 6.6 million, including:

- 550,000 postpaid net adds with:

- 468,000 postpaid phone net adds

- (48,000) postpaid tablet and other branded computing device net losses

- 130,000 other net adds

- 26,000 prepaid phone net adds

- Postpaid churn improved to 0.95% versus 1.01% in the year-ago quarter.

- Postpaid phone churn improved to 0.79% versus 0.84% in the year-ago quarter.

- Prepaid churn was 2.78%, with Cricket substantially lower, versus 2.83% in the year-ago quarter.

- Postpaid phone ARPU was $55.99, up 0.6% versus the year-ago quarter, due to pricing actions, higher international roaming and a mix shift to higher-priced unlimited plans.

- FirstNet connections reached about 5.3 million across nearly 27,000 agencies. FirstNet is the nationwide communications platform dedicated to public safety. The AT&T and FirstNet networks cover more than 99% of the U.S. population, and FirstNet covers more first responders than any other network in America.

Business Wireline

- Revenues were $5.2 billion, down 7.9% year over year due to lower demand for legacy voice and data services and product simplification, partly offset by growth in connectivity services. This quarter also included approximately $100 million in revenues from intellectual property sales, which were relatively consistent with the prior year.

- Operating expenses were $4.9 billion, down 3.5% year over year due to lower personnel costs associated with ongoing transformation initiatives, and lower wholesale network access, customer support and marketing expenses.

- Operating income was $350 million, down 43.6%, with operating income margin of 6.7% compared to 11.0% in the year-ago quarter.

- EBITDA* was $1.7 billion, down 13.7% year over year with EBITDA margin* of 32.5%, compared to 34.6% in the year-ago quarter. The company now expects full-year Business Wireline EBITDA* declines in the low-double digits, versus prior guidance of high-single digit declines.

- AT&T Business serves the largest global companies, government agencies and small businesses. More than 800,000 U.S. business buildings are lit with fiber from AT&T, enabling high-speed fiber connections to approximately 3.3 million U.S. business customer locations. Nationwide, more than 10 million business customer locations are on or within 1,000 feet of our fiber.3

Consumer Wireline

- Revenues were $3.3 billion, up 4.6% year over year due to gains in broadband more than offsetting declines in legacy voice and data and other services. Broadband revenues increased 9.8% due to fiber growth of 26.9%, partly offset by a 9.0% decline in non-fiber revenues. The company now expects full-year broadband revenue growth of 7%+, versus prior guidance of 5%+.

- Operating expenses were $3.2 billion, up 4.2% year over year due to higher depreciation expense and higher network-related costs, partly offset by lower customer support costs.

- Operating income was $160 million, up 12.7% year over year with operating income margin of 4.8%, compared to 4.5% in the year-ago quarter.

- EBITDA* was $1.0 billion, up 9.4% year over year with EBITDA margin* of 31.0%, up from 29.6% in the year-ago quarter.

- Total broadband net gains, excluding DSL and including AT&T Internet Air, were 15,000, reflecting AT&T Fiber net adds of 296,000, more than offsetting losses in non-fiber services. AT&T Fiber is now capable of serving 20.7 million customer locations and offers symmetrical, multi-gig speeds across parts of its entire footprint of more than 100 metro areas.

Latin America – Mexico Operational Highlights

Revenues were $992 million, up 26.4% year over year due to growth in both service and equipment revenues. Service revenues were $672 million, up 20.2% year over year, driven by favorable foreign exchange and essentially stable subscriber and wholesale revenues. Equipment revenues were $320 million, up 41.6% year over year due to higher sales and favorable foreign exchange.

Operating loss was ($29) million compared to ($63) million in the year-ago quarter. EBITDA* was $155 million compared to $101 million in the year-ago quarter.

Total wireless net adds were 65,000, including 17,000 prepaid net adds, 55,000 postpaid net adds and 7,000 reseller net losses.

Read more Investor Relations news